Employer payroll tax calculator

Free Unbiased Reviews Top Picks. The document has moved here.

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator Our payroll tax calculator is designed to help you quickly calculate payroll deductions and withholdings for your employees.

. Ad Get Started Today with 2 Months Free. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Free Unbiased Reviews Top Picks.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. If youre a new employer youll pay a flat rate of 3525. The wage base is 8000 for 2022 and rates range from 0725 to 7625.

Ad Launch your own payroll PEO product and increase your ARR by 4235. Get Your Quote Today with SurePayroll. Example Medicare withholding calculation.

The standard FUTA tax rate is 6 so your max. Increase revenue generation with our embedded payroll product. To calculate Medicare withholding multiply your employees gross pay by the current Medicare tax rate 145.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Get an accurate picture of the employees gross pay. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

The Excel Version of the Employee Cost Calculator cost. Employer Payroll Tax Calculator One simple tool can estimate your tax deductions and withholdings making payroll processing accurate quick and easy. Use the Free Paycheck Calculators for any gross-to-net calculation need.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Over 900000 Businesses Utilize Our Fast Easy Payroll. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Employers can use it to calculate net pay and figure out how. Important note on the salary paycheck calculator. View FSA Calculator A.

The calculator includes options for estimating Federal Social Security and Medicare Tax. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Important note on the salary paycheck calculator.

Learn About Payroll Tax Systems. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck. Payroll So Easy You Can Set It Up Run It Yourself.

This paycheck calculator can help you do the math for all your employee and employer payroll taxes and free you up to do what you do best. Summarize deductions retirement savings required taxes and more. Heres how it works.

2020 Federal income tax withholding. With this calculator its easier to plan for the. All Services Backed by Tax Guarantee.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Learn About Payroll Tax Systems. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Sign Up Today And Join The Team. Ad Compare This Years Top 5 Free Payroll Software.

Manage payroll for Free Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Register to save paychecks generate form 941 w2 etc. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Sign Up Today And Join The Team.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Remember paying your SUI in full and on time. Ad Compare This Years Top 5 Free Payroll Software.

It only takes a few seconds to. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios.

Paycheck Calculator Take Home Pay Calculator

Employer Payroll Tax Calculator Incfile Com

Tax Calculator For Wages Online 56 Off Www Ingeniovirtual Com

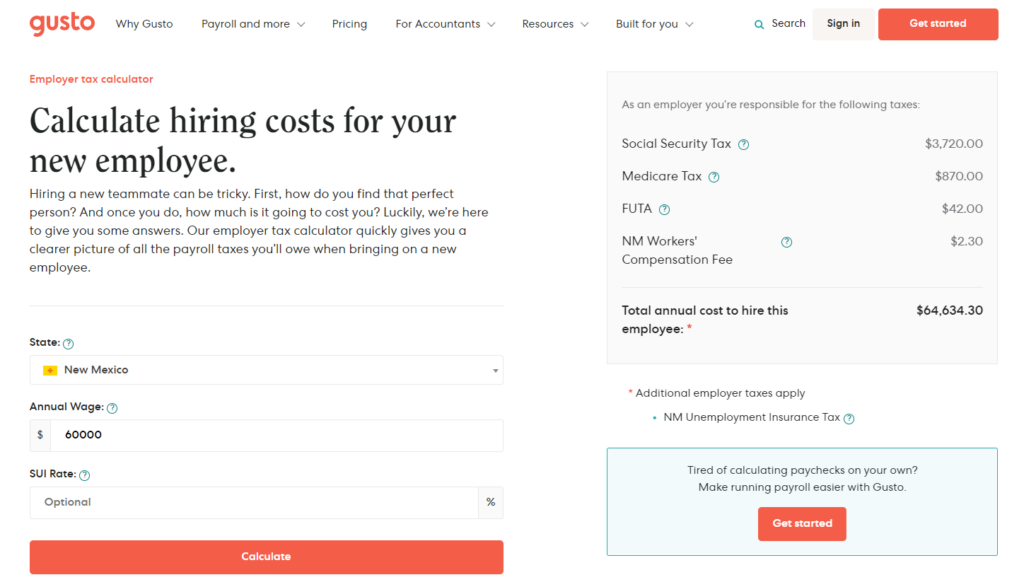

Payroll Tax Calculator For Employers Gusto

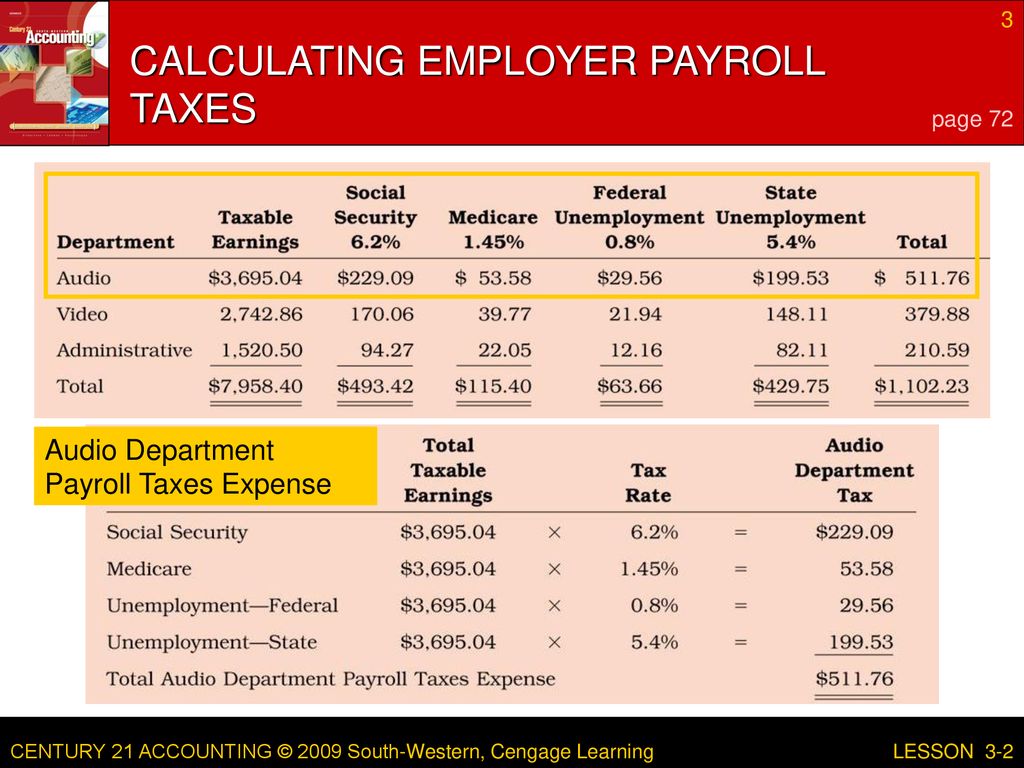

Lesson 3 2 Recording A Payroll And Payroll Taxes Ppt Download

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Employer Payroll Tax Liability Tax Deposits And Fraction Of Cents For Form 941 Paycheck Manager

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Payroll Taxes In 5 Steps

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes Methods Examples More

Free Payroll Calculator And You Can Register To Save Paychecks Compute Employer S Taxes And Manage Payroll For Free Payroll Taxes Payroll Paycheck